The tax regime sets the tax slabs and rates. In 2020, the government introduced a new tax regime that offers more tax-saving options but comes with higher tax rates. The new regime also allows taxpayers to choose between the old and new regimes, which makes taxation more complicated yet flexible since different taxpayers benefit differently under the two regimes. In Keka, employees can switch between the tax regimes and determine which one is more advantageous for them.

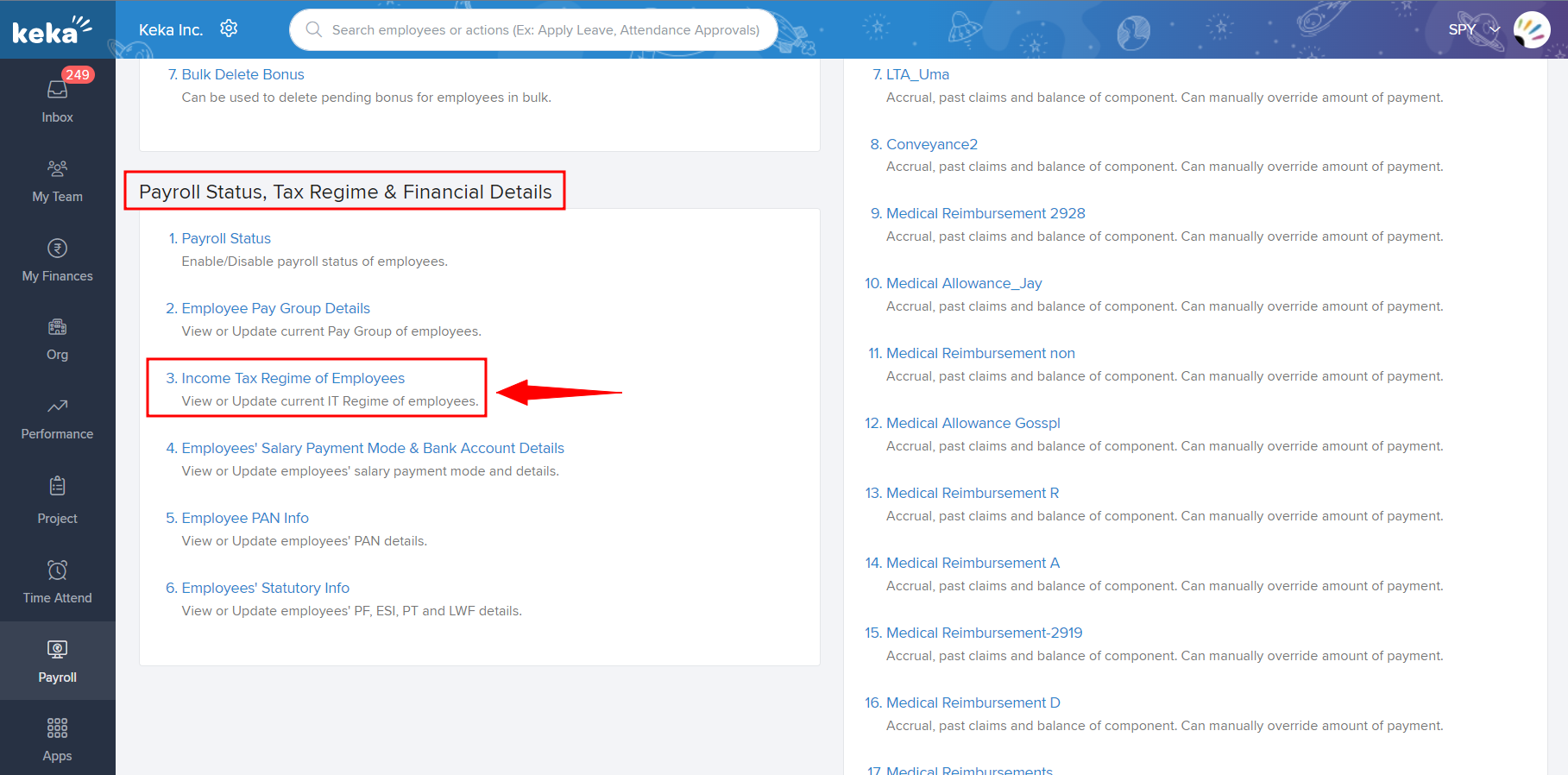

To check what tax regime an employee is in, log in to your Keka portal and click on the Payroll (1) tab. Go to Payroll Admin (2) and find Operations (3) under it.

Here you have to select the Pay Group and the Financial year for which you want to check the tax regime and then click Run.

Now you can check the Income Tax Regime of the employee in the generated list.

This list can also be filtered based on the Location, Business Unit, Department, and Employment Status of the employees.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article